Margin Trading Strategy: Trade with the Trend

A comprehensive introduction to Margin trading strategies. Identify the trend and buying/selling signals to trade and profit smartly. Avoid the sway of emotion in trading!

1. Recognize trends

A trend is a direction in which the market will go, be on the rise, fall, or even sideways.

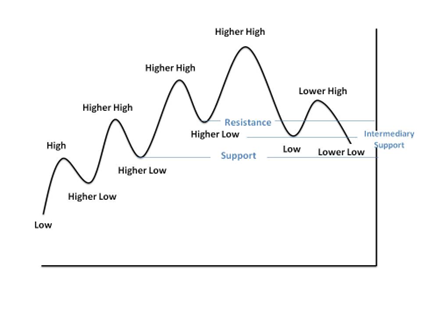

The appearance of the cryptocurrency trend is like the movement of waves; the market price will not go straight in a certain direction, but the trajectory of the trend movement is tortuous and meandering. According to the positional relationship between the wave peaks and troughs, the trend is divided into an upward trend, a downward trend, and a sideways trend.

Uptrend: The peaks and troughs continue to rise and break through the previous high/low.

Downtrend: The peaks and troughs gradually decrease and fall below the previous high/low.

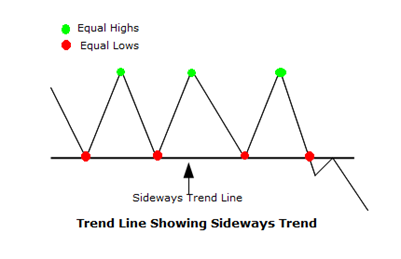

Sideways Trend: there is not a clear direction of the trend. The price is waving up and down between the support and resistance level.

2. Trading Strategies in the unilateral market

When the market is unilaterally rising or falling, you can utilize trading strategies such as Buy and Hold or Trend Trading Strategies to maximize profits in trading.

Trend trading, which holds a position for an extended period, usually not less than a few months. Trend traders try to take advantage of directional trends for profit. Buy long in an uptrend and sell short in a downtrend. Warm reminder, trend trading needs to be alert to the reversal of the market.

Buy and Hold, traders can buy assets that they plan to hold for a long time, no matter how the market fluctuates. If you are bullish for a long time, you can do long with low leverage to amplify long-term profits, while maintaining a low debt ratio to ensure the safety of your account.

Advantage:

1) In a bear market, you can make a profit by shorting.

2) In a bull market, you can grow the profit by long with low leverage.

3) After the trend direction is clear, you don’t need to watch the charts frequently.

Disadvantage: The long-term strategies are not suitable for sideways markets. And long-term holding positions will continue to generate interest.

3. Trading Strategies in the sideways market

When the market swings up and down in a specific price zone, you can effectively use the volatility band for short-term or middle-term trading. Fast enter and fast exit to profit from the band.

Short-term trading refers to a short-term trading process. The holding time usually varies from a few hours to one day, no more than 24 hours. Short-term traders try to capture the ups and downs of the market in the short term. Ultra-short-term trading (Scalping) and day trading are typical short-term trading strategies.

Middle-term trading mainly refers to Swing trading. The holding time usually varies from days to weeks, generally more than 24 hours but no more than 1 month.

Ultra-short-term trading (Scalping) is one of the fastest trading strategies. The core idea is to avoid holding positions for a long time. The focus of an ultra-short-term trading strategy is to repeatedly capitalize on small changes in the market to profit from bid-ask spreads, liquidity gaps, or other inefficiencies in the market.

Day trading is a short-term trading method that traders usually complete within 24 hours or less. A day trader’s goal is to capitalize on intraday price movements (that is, price movements within a single trading day).

Swing Trading: A position is held for more than a day, but usually no more than a few weeks or a month, somewhere between day trading and trend trading. Swing traders are middle-term traders; they sit between the long-term trading and the day traders. Swing traders usually make full use of the swings actively in volatility to trade and achieve the purpose of profiting in the sideways market.

Take Swing Trading as an example to learn more about indicators.

4. Swing Trading

4.1 Things about the K line (candlestick charts)

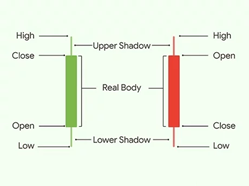

The candlestick chart graphically presents the price movement over a specific period. As the name suggests, a candlestick chart consists of candlesticks, each representing the same amount of time. You can check 1min, 15min, 30min, 60min, 2H, 4H, 8H, 1D, 7D charts, and more.

When creating each candlestick chart, the following price points must be established:

Open Price — The first recorded trading price of the asset within that particular period.

High Price — The highest recorded trading price of the asset within that specified period.

Low Price — The lowest recorded trading price of the asset within that specified period.

Close Price— The last recorded trading price of the asset within that specified period.

4.2 The previous highs and previous lows in candlestick charts

4.3 Find the best points in candlestick charts

Support and Resistance Levels

Support is the lowest point of the moving average in a certain period, and resistance is the highest point of the moving average in a certain period. Generally, the best buy/sell points to trade are also near support/resistance levels.

Buy and Sell Signals

The current trend can be predicted and judged according to the K-line pattern and the moving average support and resistance. After the trend is clear, it is necessary to choose the best buy/sell point. A better point can not only increase the profit space but also greatly reduce the trading risk.

Stop Loss and Take Profit point

Risk management needs to be included in a reasonable trading strategy, and it is recommended to stop profit and loss in time in any transaction. Take-Profit can settle the profitable part to avoid subsequent market changes by reducing profit or even loss, and Stop-Loss can avoid further expansion of losses and control the risk within an acceptable range.

Advantages:

1) It is suitable for all market situations, uptrend, downtrend, and sideways. There are waves, there are profit opportunities. Fast enter and fast exit to profit.

2) In the sideways market, swing trading is a good way to improve long-term holding funds' utilization rate to increase your assets actively.

3) Make use of the swings to find the best buy and sell signals; you can amplify your profits and take profit and stop loss in time at the best positions.

Disadvantages:

Swing trading requires traders to have a knowledge of technical analysis and tools.

Tips:

1. There are many kinds of trading strategies; please do your research and set up your trading strategy;

2. Margin trading is risky, and it is recommended to set low leverage and control trading risks.